The Series 66 exam is a closed-book test, requiring thorough preparation. A Series 66 study guide is essential for understanding federal and state securities laws, ethical practices, and fiduciary duties. Kaplan offers comprehensive materials to help candidates pass on their first attempt.

1.1 Overview of the Series 66 Exam

The Series 66 exam is a closed-book, 110-question uniform combined state law exam administered by NASAA. It covers federal and state securities laws, ethical practices, and fiduciary duties. Candidates must demonstrate a strong understanding of investment products, trading practices, and regulatory requirements. The exam is designed to ensure competence in advising clients on securities transactions and managing their investments responsibly. A Series 66 study guide is crucial for preparation, as it provides detailed insights into exam topics and helps candidates navigate complex legal and ethical concepts. Passing the exam is a key step toward obtaining a securities license and advancing a career in financial services.

1.2 Importance of the Series 66 Exam in Securities Licensing

The Series 66 exam is a critical requirement for securities licensing, enabling professionals to sell investment products and provide financial advice. It is mandated by the North American Securities Administrators Association (NASAA) and demonstrates a comprehensive understanding of federal and state securities laws, ethical practices, and fiduciary duties. Passing the exam is essential for registering as a securities agent or investment advisor representative, ensuring compliance with regulatory standards. It also highlights a professional’s commitment to ethical conduct and legal knowledge, making it a cornerstone for career advancement in the financial services industry.

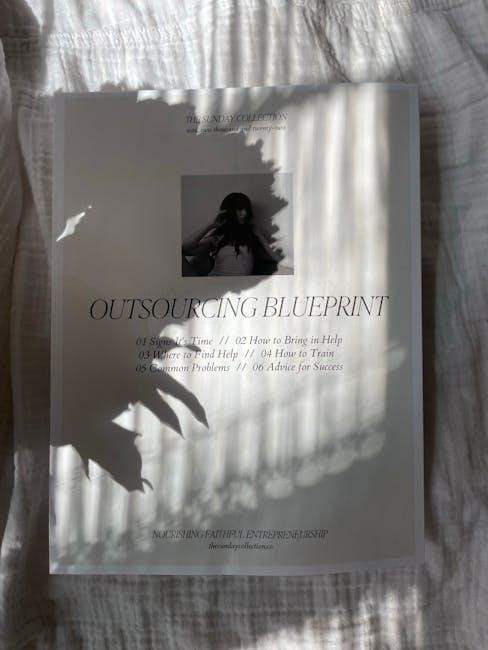

Structure of the Series 66 Study Guide

The Series 66 study guide includes a 12-chapter manual, 10 final exams, and 110-question practice tests with explanations. It aligns with exam objectives, covering laws, ethics, and fiduciary duties.

2.1 Key Components of the Study Guide

The Series 66 study guide includes comprehensive chapters on federal and state securities laws, ethical practices, and fiduciary duties. It features detailed explanations, practice questions, and real-world examples to enhance understanding. The guide is structured to align with exam objectives, ensuring candidates cover all essential topics. Additional resources, such as practice exams and flashcards, are often included to reinforce learning. The guide also emphasizes ethical standards and regulatory compliance, which are critical for success. By focusing on these components, the study guide provides a thorough preparation framework for the Series 66 exam, helping candidates build a strong foundation for their career in securities licensing.

2.2 How the Study Guide Aligns with the Exam Objectives

The Series 66 study guide is designed to align closely with the exam objectives, ensuring comprehensive preparation. It covers federal and state securities laws, ethical practices, and fiduciary duties, mirroring the exam’s focus areas. The guide includes practice exams and detailed explanations, helping candidates understand complex topics. By organizing content according to the exam’s structure, the guide enables focused study, ensuring all objectives are met. This alignment is crucial for mastering the material and achieving success on the Series 66 exam.

Eligibility and Registration for the Series 66 Exam

To register for the Series 66 exam, candidates must meet specific requirements. Sales representatives and professionals in securities roles often need to pass this exam. Registration involves completing necessary forms and meeting eligibility criteria, ensuring candidates are prepared for the exam’s demands.

3.1 Who Should Take the Series 66 Exam

The Series 66 exam is designed for professionals in the financial industry, particularly those involved in securities sales and investment advice. It is ideal for financial advisors, stockbrokers, and investment professionals who need to demonstrate competency in both federal and state securities laws. Candidates must also pass the Series 7 exam to become fully registered representatives. Additionally, individuals seeking to work as investment adviser representatives may combine the Series 66 with the Series 65 exam. This exam is a critical step for anyone aiming to advise clients on securities and investment products, ensuring compliance with ethical and legal standards.

3.2 Registration Process and Requirements

To register for the Series 66 exam, candidates must meet specific eligibility criteria. Typically, candidates must be sponsored by a FINRA member firm or associated with a state securities regulator. The registration process involves submitting Form U4 through the Central Registration Depository (CRD) system. A fee is required, and candidates must pass a background check. Additionally, candidates are encouraged to use a Series 66 study guide to prepare for the exam, as it covers essential topics like federal and state securities laws. Proper registration ensures compliance with regulatory requirements, and thorough preparation is key to success.

Study Materials and Resources

Recommended Series 66 study materials include Kaplan’s License Exam Manual and STC Study Material. These resources provide comprehensive coverage of exam topics and practice exams for preparation.

4.1 Recommended Study Materials for the Series 66 Exam

Essential study materials for the Series 66 exam include the Series 66 Study Guide, which covers federal and state securities laws, ethical practices, and fiduciary duties. Kaplan offers a comprehensive License Exam Manual (LEM) and online tools like QBank for practice questions. Additionally, STC provides a 12-chapter study manual and 110-question practice exams. Pass the Test, Inc. also offers a detailed guide to help candidates prepare effectively. These resources ensure a structured approach to mastering the exam content and understanding complex topics like laws, regulations, and ethical standards.

4.2 Role of the Series 66 Study Guide in Preparation

The Series 66 study guide plays a pivotal role in exam preparation by providing a structured approach to mastering federal and state securities laws, ethical practices, and fiduciary duties. It serves as a primary resource, breaking down complex topics into digestible sections. The guide aligns closely with exam objectives, ensuring candidates focus on critical areas. Additionally, it includes practice exams and detailed explanations, helping individuals identify and address weaknesses. By reinforcing key concepts and offering practical insights, the study guide is an indispensable tool for achieving success on the Series 66 exam.

Key Topics Covered in the Series 66 Exam

The exam covers federal securities laws, state securities laws, ethical practices, and fiduciary duties, ensuring a comprehensive understanding of regulatory requirements and professional standards in the securities industry.

5.1 Federal Securities Laws and Regulations

The Series 66 exam extensively covers federal securities laws, including the Securities Act of 1933 and the Securities Exchange Act of 1934. These laws regulate the issuance and trading of securities, ensuring transparency and investor protection. The study guide emphasizes key regulations enforced by the SEC, such as disclosure requirements and prohibitions against fraudulent activities. Understanding these laws is critical for candidates, as they form the foundation of ethical practices and fiduciary duties in the financial industry. The guide provides detailed explanations and examples to help candidates master these complex legal concepts effectively.

5.2 State Securities Laws and Regulations

The Series 66 exam extensively covers state securities laws and regulations, which vary by jurisdiction but aim to protect investors and maintain fair markets. Key topics include registration requirements for securities and investment advisers, as well as enforcement mechanisms. Understanding state-specific rules is crucial, as they often complement federal regulations. The exam also emphasizes fiduciary duties and ethical standards expected of professionals. Study materials, such as the Series 66 study guide, provide detailed insights into these laws, ensuring candidates are well-prepared to navigate both state and federal regulatory frameworks effectively. This knowledge is essential for adhering to legal and ethical practices in the securities industry.

5.3 Ethical Practices and Fiduciary Duties

Ethical practices and fiduciary duties are critical components of the Series 66 exam, emphasizing the importance of adhering to moral standards and legal obligations. The study guide provides detailed insights into these principles, ensuring candidates understand their role in maintaining client trust and avoiding conflicts of interest. Topics include fiduciary responsibilities, disclosure requirements, and ethical decision-making frameworks. Real-world examples and case studies help illustrate practical applications, reinforcing the importance of upholding ethical standards in financial advisory roles. Mastery of these concepts is essential for both exam success and professional integrity in the securities industry.

Preparation Strategies for the Series 66 Exam

Effective study techniques include active learning and regular practice exams. Organize your schedule, focusing on weak areas identified through practice tests to ensure comprehensive understanding and retention.

6.1 Effective Study Techniques for the Series 66 Exam

Effective study techniques for the Series 66 exam involve active learning and structured preparation. Use a Series 66 study guide to focus on key topics like securities laws and ethical practices. Break study sessions into manageable chunks, emphasizing understanding over memorization. Incorporate flashcards for quick concept reviews and practice exams to assess readiness. Kaplan’s materials, including their License Exam Manual (LEM), provide structured content for comprehensive preparation. Regularly review and summarize notes to reinforce learning. Utilize online resources and live classes for additional support. Consistency and a well-organized study plan are critical for mastering the exam material effectively.

6.2 Time Management Tips for Exam Preparation

Effective time management is crucial for mastering the Series 66 exam. Create a structured study schedule, allocating specific time slots to each topic, such as federal securities laws or ethical practices. Dedicate consistent hours daily to review the Series 66 study guide and practice exams. Prioritize challenging areas and break study sessions into manageable chunks to maintain focus. Use a timer during practice tests to simulate exam conditions, enhancing your ability to answer questions efficiently. Avoid cramming by spreading preparation over weeks, ensuring thorough understanding and retention of material. Stay organized and track progress to stay on track.

Practice Exams and Their Importance

Practice exams are crucial for identifying weaknesses and improving understanding. They simulate real test conditions, helping candidates assess readiness and refine their knowledge of federal and state laws.

7.1 Benefits of Taking Practice Exams

Taking practice exams is crucial for Series 66 exam preparation. They help candidates familiarize themselves with the exam format, identify knowledge gaps, and improve time management. Practice exams simulate real test conditions, reducing anxiety and building confidence. By reviewing answers, candidates can focus on weak areas and refine their study strategies. Utilizing resources like the Series 66 study guide alongside practice exams ensures a well-rounded understanding of topics such as federal securities laws and ethical practices. Regular practice exams are a proven way to enhance retention and readiness, increasing the likelihood of passing the exam on the first attempt.

7.2 How to Use Practice Exams to Identify Weaknesses

Practice exams are invaluable for identifying weaknesses in your preparation for the Series 66 exam. By simulating real test conditions, they reveal areas where you need improvement. Reviewing explanations for incorrect answers helps clarify misunderstandings. Track your performance over time to focus on topics requiring more study. Ethical practices and fiduciary duties are critical areas to master. Use practice exams to refine your knowledge and build confidence. Regularly assessing your progress ensures you address gaps before the actual exam, maximizing your chances of success. This targeted approach is essential for achieving a passing score and excelling in the exam;

Exam Format and Question Types

The Series 66 exam is a closed-book, 110-question test with a 180-minute time limit. It includes multiple-choice and case study questions, focusing on federal and state securities laws.

8.1 Overview of the Exam Format

The Series 66 exam is a closed-book, multiple-choice test consisting of 110 questions. Candidates have 180 minutes (3 hours) to complete it. The exam covers federal and state securities laws, ethical practices, and fiduciary duties. Questions are designed to assess knowledge and application of key concepts; The passing score is 73%. The exam is administered by the North American Securities Administrators Association (NASAA). A Series 66 study guide helps candidates understand the format and focus on critical areas. Proper preparation ensures familiarity with question types and timing, increasing chances of success on exam day.

8.2 Types of Questions on the Series 66 Exam

The Series 66 exam features multiple-choice questions designed to test knowledge of securities laws, ethical practices, and fiduciary duties. Questions are scenario-based, requiring application of concepts to real-world situations. The exam also includes definition-based questions to assess understanding of key terms and regulations. Practice exams, such as those in the Series 66 study guide, mirror the actual test format, helping candidates familiarize themselves with question types and identify areas for improvement. This preparation is crucial for tackling the exam’s challenging content effectively.

Common Challenges and Mistakes

Candidates often struggle with applying knowledge practically rather than just memorizing. Overlooking ethical practices and poor time management are common pitfalls. Practice exams help identify such weaknesses effectively.

9.1 Common Mistakes Candidates Make

Candidates often underestimate the exam’s difficulty, relying solely on memorization rather than understanding concepts. Many fail to adequately practice with sample questions, leading to time management issues during the test. Others neglect to thoroughly review ethical practices and fiduciary duties, which are heavily emphasized. Some candidates also overlook the importance of understanding both federal and state securities laws, focusing too narrowly on one area. Additionally, not utilizing a Series 66 study guide or practice exams can leave candidates unprepared for the exam’s format and question types, increasing the likelihood of errors and missed opportunities to demonstrate knowledge.

9.2 How to Overcome Common Challenges

To overcome common challenges, candidates should focus on understanding core concepts rather than memorizing information. Utilize practice exams to identify weaknesses and refine test-taking strategies. Break down complex topics into manageable sections and review frequently. Time management is crucial; allocate specific study hours daily to maintain consistency. Engage in active learning techniques, such as summarizing key points or teaching concepts to others. Leverage the Series 66 study guide to organize your preparation and ensure comprehensive coverage of all exam topics. Prioritize ethical practices and fiduciary duties, as these are heavily emphasized in the exam. Stay disciplined and maintain a positive mindset.

Tips for Passing the Series 66 Exam

Use a Series 66 study guide to master federal and state securities laws. Practice with practice exams to identify weaknesses and improve time management. Understand ethical practices thoroughly for success.

10.1 Strategies for Success on Exam Day

On exam day, arrive early and stay calm. Use the Series 66 study guide for last-minute reviews, focusing on ethical practices and fiduciary duties. Manage your time wisely, answering easier questions first. Utilize Kaplan’s resources for final preparation. Avoid guessing; instead, eliminate incorrect options. Stay hydrated and maintain a positive mindset. Review state and federal securities laws briefly before starting. Practice deep breathing to reduce stress. Ensure you understand question formats from practice exams. Trust your preparation and approach each question systematically. Remember, the Series 66 exam is closed-book, so rely on your studied knowledge.

10.2 Importance of Understanding Ethical Practices

Understanding ethical practices is crucial for passing the Series 66 exam and maintaining professional integrity. Ethical standards ensure fair treatment of clients and adherence to legal obligations. The exam emphasizes fiduciary duties, requiring candidates to grasp how ethical decisions impact client relationships and regulatory compliance. Ignoring ethical practices can lead to legal consequences and damage to reputation. A Series 66 study guide provides detailed insights into ethical guidelines, helping candidates navigate complex scenarios and apply principles effectively. Mastery of ethical practices not only aids in exam success but also fosters trust and long-term success in the securities industry.

Final Preparation and Review

Use the Series 66 study guide for last-minute review, focusing on ethical practices and state laws. Practice exams help identify weaknesses, ensuring readiness for the exam.

11.1 Last-Minute Tips for Final Review

For a final review, focus on weak areas identified through practice exams. Use flashcards to memorize key terms and concepts. Practice with sample questions to build confidence. Review the Series 66 study guide thoroughly, emphasizing ethical practices and fiduciary duties. Allocate time to revisit federal and state securities laws. Ensure a good night’s sleep before the exam and arrive early. Stay calm and manage time effectively during the test. These strategies will help maximize readiness and performance.

11.2 Ensuring Readiness for the Exam

To ensure readiness for the Series 66 exam, candidates should conduct a final review of all study materials, focusing on weak areas identified through practice exams. Utilize the Series 66 study guide to reinforce understanding of federal and state securities laws, ethical practices, and fiduciary duties. Practice exams help assess knowledge retention and time management skills. Reviewing explanations for incorrect answers is crucial for clarification. Ensure familiarity with the exam format and question types to avoid surprises. Confidence and thorough preparation are key to performing well on exam day.

Next Steps After Passing the Exam

After passing the Series 66 exam, professionals can pursue roles like financial advisor or investment representative. Regular license renewal and ongoing education are required to maintain certification.

12.1 Career Opportunities After Passing the Series 66 Exam

Passing the Series 66 exam unlocks diverse career opportunities in the financial services industry. Candidates become eligible to work as Investment Adviser Representatives or securities agents, offering advisory services and selling securities. This qualification is highly valued in roles such as financial advisor, investment consultant, or registered representative. Professionals can pursue careers in brokerage firms, investment advisory firms, or banks. The exam equips individuals with a deep understanding of securities laws and ethical practices, making them competitive in the job market. It also opens pathways to advanced roles in wealth management and financial planning, enhancing long-term career growth and earning potential;

12.2 Maintaining and Renewing Your License

Maintaining the Series 66 license requires completing continuing education courses to stay updated on industry regulations and ethical practices. The Series 66 study guide provides resources for ongoing learning, ensuring professionals meet renewal requirements. License holders must adhere to fiduciary duties and ethical standards, as outlined in the guide. Regular updates on securities laws and regulatory changes are essential for renewal. By leveraging the study guide, professionals can efficiently manage their license maintenance and uphold professional standards in the securities industry.