Filing an estate tax return in New Jersey ensures compliance with state tax laws‚ accurately reporting the decedent’s assets and liabilities. The legal representative must ensure all requirements are met to avoid penalties.

Overview of the NJ Estate Tax

The New Jersey Estate Tax applies to the transfer of a decedent’s assets‚ requiring the legal representative to file a return within nine months of death. The tax is based on the gross estate value‚ including assets and adjusted taxable gifts. The estate must report all known assets‚ debts‚ and beneficiaries to the NJ Division of Taxation. Forms such as NJ-1041 and IT-R are used for this purpose. The tax helps fund state programs‚ and the legal representative is responsible for ensuring compliance and accurate reporting. Additional information and forms are available on the NJ Division of Taxation website.

Importance of Filing an Estate Tax Return

Filing an estate tax return is crucial for ensuring compliance with New Jersey tax laws and preventing penalties. It provides a complete record of the decedent’s assets‚ debts‚ and beneficiaries‚ ensuring fair distribution and accurate tax calculation. Timely filing avoids interest and penalties‚ and it allows the estate to close efficiently. Executors must submit the return within nine months of death‚ with an optional six-month extension. Proper filing also ensures that all applicable exemptions and deductions are considered‚ minimizing tax liability. The estate tax return is essential for settling the decedent’s financial affairs responsibly and transparently.

The Filing Process

The filing process involves determining if a return is needed‚ gathering documents‚ completing forms like IT-R and NJ-1041‚ and submitting them with payments by the deadline.

Step 1: Determine If an Estate Tax Return Is Required

The first step in the filing process is to determine if an estate tax return is necessary. This is done by calculating the decedent’s gross estate and adjusted taxable gifts. According to the New Jersey Division of Taxation‚ if the gross estate plus adjusted taxable gifts exceeds the applicable exemption amount‚ an estate tax return must be filed. It is crucial to accurately assess the value of all assets‚ including real property‚ securities‚ and other tangible items‚ to ensure compliance with state tax regulations. Proper determination avoids potential penalties and ensures timely submission of the required documents.

Step 2: Gather Necessary Documents and Information

Gathering all necessary documents and information is critical for accurately completing the estate tax return. This includes the decedent’s will‚ deeds‚ financial statements‚ and tax returns. Collect detailed records of assets‚ such as real estate‚ securities‚ and personal property‚ along with their valuations. Beneficiary information and any outstanding debts or liabilities must also be compiled. The legal representative should ensure all documents are organized and readily accessible to streamline the filing process. Accurate and complete information is essential for compliance with New Jersey tax regulations and to avoid delays or penalties.

Step 3: Complete the Required Forms

Once all necessary documents are gathered‚ the next step is to complete the required forms accurately. The legal representative must fill out Form IT-R (Inheritance Tax Return) and Form NJ-1041 (NJ Estate Tax Return)‚ ensuring all information aligns with the decedent’s assets‚ liabilities‚ and beneficiaries. Form NJ-1041SB may also be needed for specific elections or filing instructions. Each form must be thoroughly reviewed for accuracy‚ as errors can lead to delays or penalties. The representative should carefully follow the instructions provided by the NJ Division of Taxation to ensure compliance with state tax laws. Completing these forms accurately is essential for a smooth filing process. Professional assistance may be beneficial for complex cases.

Step 4: Submit the Return and Payments

After completing the forms‚ the legal representative must submit the return and any required payments to the NJ Division of Taxation. The completed tax return should be mailed to PO Box 249‚ Trenton‚ NJ 08695-0249‚ or faxed to (609) 292-5033. Payments must be made payable to “NJ Inheritance and Estate Tax.” It is crucial to keep a copy of the submitted return and all supporting documents for records. Late submissions may result in penalties‚ so ensuring timely filing is essential. Properly submitting the return and payments completes the filing process and fulfills the legal representative’s obligation to the state.

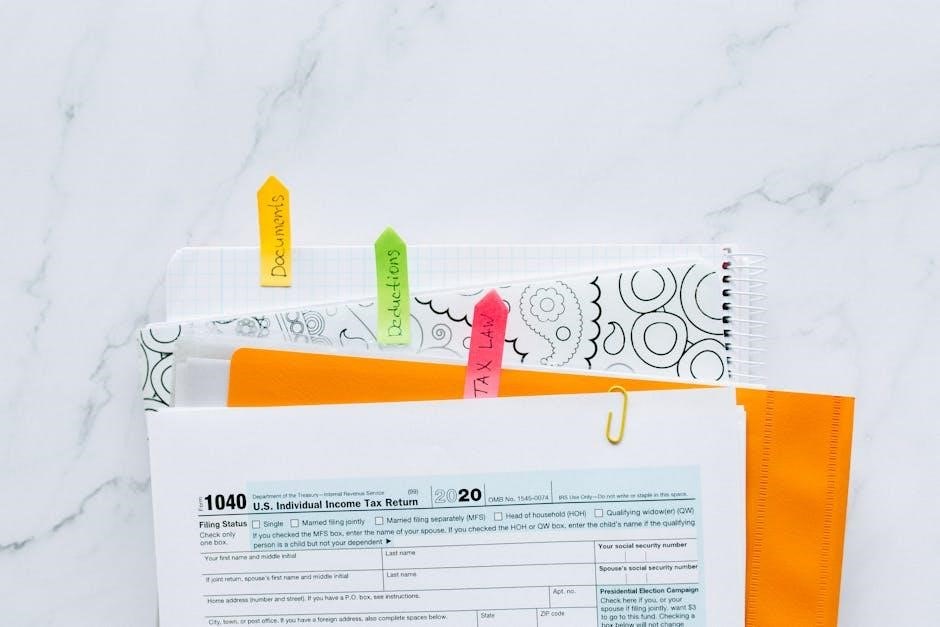

Key Forms and Instructions

Essential forms for NJ estate tax filing include Form IT-R for inheritance tax‚ Form NJ-1041 for estate tax‚ and Form NJ-1041SB for election details and filing guidance.

Form IT-R: Inheritance Tax Return

Form IT-R is the official Inheritance Tax Return required by the New Jersey Division of Taxation. This form must be filed by the legal representative of the estate and includes detailed information about the decedent’s assets‚ liabilities‚ and beneficiaries as of the date of death. It serves as an affidavit to report all known assets and debts‚ ensuring accurate calculation of the inheritance tax liability. The completed form should be submitted to the NJ Division of Taxation at the specified address. It is essential to include all supporting documents and retain a copy for records;

Form NJ-1041: NJ Estate Tax Return

Form NJ-1041 is used to report the income earned by an estate after the decedent’s death. It is required for both federal and New Jersey state tax purposes. The form details income such as dividends‚ interest‚ and rental income‚ as well as deductions and credits applicable to the estate. It is crucial for ensuring compliance with tax laws and accurately reflecting the estate’s financial activities. The form must be filed with the New Jersey Division of Taxation‚ and instructions are available on their official website. Proper completion of Form NJ-1041 is essential for avoiding penalties and ensuring timely processing of the estate’s tax obligations.

Form NJ-1041SB: Election Information and Filing Instructions

Form NJ-1041SB provides essential election information and filing instructions for estates. It is used to report specific elections and filing details required for New Jersey tax purposes. The form includes information about the estate’s status‚ beneficiary details‚ and any special elections made under New Jersey tax law. It is particularly relevant for estates other than those of a deceased individual. The form must be completed accurately and submitted alongside the NJ-1041 Estate Tax Return. Instructions for completing Form NJ-1041SB are available on the New Jersey Division of Taxation’s official website‚ ensuring compliance with state tax regulations.

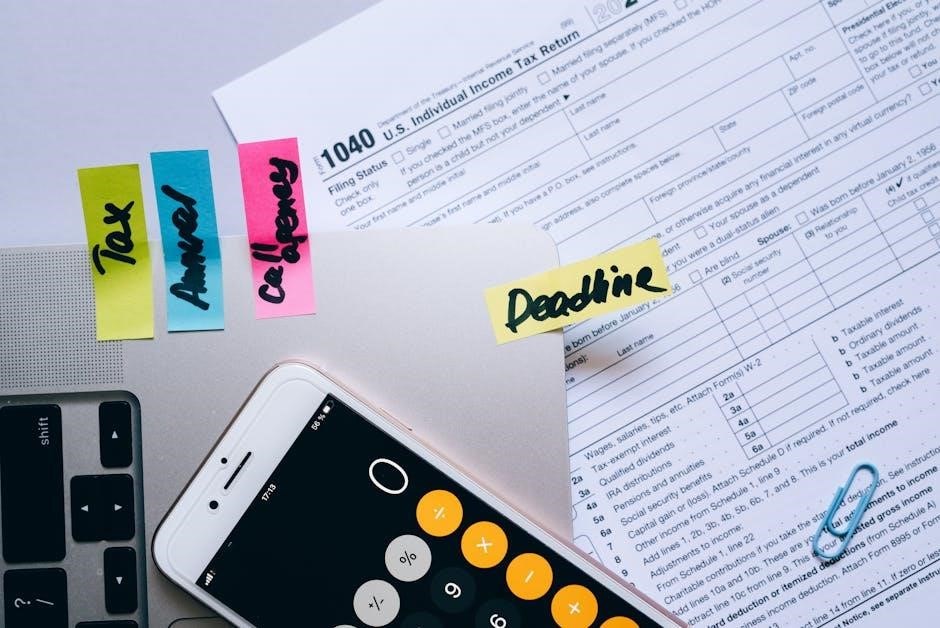

Deadlines and Extensions

Estate tax returns must be filed within nine months of the decedent’s death‚ with an automatic six-month extension available upon request.

Filing Deadline: 9 Months from the Date of Death

The New Jersey estate tax return must be filed within nine months of the decedent’s death. This deadline is strictly enforced‚ and missing it may result in penalties. Executors or legal representatives are responsible for ensuring timely submission. The nine-month period begins on the date of death‚ allowing sufficient time to gather necessary documents and complete the return. If additional time is needed‚ an automatic six-month extension can be requested. Returns should be mailed to the New Jersey Division of Taxation at PO Box 249‚ Trenton‚ NJ 08695-0249. Proper filing ensures compliance and avoids potential fines or delays.

Automatic 6-Month Extension

An automatic six-month extension is available for filing the New Jersey estate tax return‚ extending the deadline to 15 months from the date of death. This extension is granted without needing to file a request. However‚ any tax due must still be paid by the original nine-month deadline to avoid penalties and interest. The extension provides additional time for preparing and submitting the return‚ ensuring accuracy and completeness. Filers must mail the completed return to the New Jersey Division of Taxation at PO Box 249‚ Trenton‚ NJ 08695-0249. Proper filing ensures compliance and avoids potential delays or fines.

Calculating the Estate Tax

Calculate the estate tax by determining the gross estate‚ including all assets and adjusted taxable gifts. Subtract applicable exemptions and deductions‚ then apply tax rates to the taxable estate.

Determining the Gross Estate

The gross estate includes all assets owned by the decedent at the time of death‚ such as real estate‚ stocks‚ bonds‚ and personal property. It also encompasses life insurance proceeds‚ retirement accounts‚ and business interests. Additionally‚ any assets transferred within three years of death may be included. The gross estate is calculated by summing the fair market value of all these assets. Accurate valuation is crucial to ensure compliance with tax laws and avoid penalties. Proper documentation‚ such as appraisals and financial statements‚ supports the reported values.

Adjusted Taxable Gifts

Adjusted taxable gifts include certain gifts made by the decedent during their lifetime that are subject to estate tax. Gifts made within three years of death are typically included in the gross estate; Taxable gifts are calculated based on their fair market value at the time of the gift. Exceptions apply for gifts to spouses‚ charities‚ or qualified educational institutions. The adjusted taxable gifts are reported on the estate tax return and may impact the overall tax liability. Proper documentation‚ such as gift tax returns and records‚ is essential for accurate reporting and compliance with tax regulations.

Applicable Exemptions and Deductions

The estate tax return allows for various exemptions and deductions to reduce the taxable estate. Exemptions include transfers to spouses‚ charities‚ and certain qualified entities. Deductions may cover administrative expenses‚ debts owed by the estate‚ and funeral costs. Gifts to educational institutions or medical facilities are also deductible. Proper documentation is required to claim these exemptions and deductions. Ensuring accurate reporting is crucial to minimize tax liability and avoid potential penalties. These provisions help in optimizing the estate’s tax burden while adhering to New Jersey’s tax regulations.

Calculating the Tax Liability

Calculating the tax liability involves determining the taxable estate value after applying exemptions and deductions. The estate tax is progressive‚ with rates varying based on the estate’s value. The Gross Estate‚ adjusted for taxable gifts‚ is subject to New Jersey’s tax rates. Forms NJ-1041 and IT-R are used to report income and calculate the tax. Accurate reporting is essential to avoid penalties. Legal representatives must ensure all deductions and exemptions are correctly applied. The tax liability is then paid according to the calculated amount‚ ensuring compliance with state tax regulations and minimizing potential disputes or additional fees.

Submission and Payment

Submit the completed return to the NJ Division of Taxation at PO Box 249‚ Trenton‚ NJ 08695-0249. Make checks payable to NJ INHERITANCE AND ESTATE TAX. Fax submissions to (609) 292-5033 and retain a copy for records.

Where to File the Return

The completed estate tax return must be submitted to the New Jersey Division of Taxation. Mail the return to PO Box 249‚ Trenton‚ NJ 08695-0249. Ensure all forms‚ including Form IT-R and NJ-1041‚ are enclosed. Payments should accompany the return‚ with checks made payable to “NJ INHERITANCE AND ESTATE TAX.” For fax submissions‚ send to (609) 292-5033. Maintain a copy of the return and supporting documents for your records. Ensure timely filing to meet the nine-month deadline from the decedent’s date of death‚ avoiding potential penalties.

Payment Methods

Payments for the New Jersey estate tax must be made by check‚ payable to “NJ INHERITANCE AND ESTATE TAX.” Include the estate’s name and tax year on the check. Mail the payment with the completed return to PO Box 249‚ Trenton‚ NJ 08695-0249. Ensure the check is properly endorsed and accompanied by the required forms. Keep a copy of the check and return for your records. Timely payment is essential to avoid penalties. If filing electronically‚ follow the instructions for online payments provided by the NJ Division of Taxation. Always verify payment methods and addresses before submitting.

Check Requirements

All checks for New Jersey estate tax payments must be made payable to “NJ INHERITANCE AND ESTATE TAX.” Include the estate’s name and tax year on the check to ensure proper processing. Mail the check with the completed return to PO Box 249‚ Trenton‚ NJ 08695-0249. Ensure the check is properly endorsed and accompanied by the required forms. Keep a copy of the check and return for your records. Timely payment is essential to avoid penalties. If filing electronically‚ follow the instructions for online payments provided by the NJ Division of Taxation. Always verify payment methods and addresses before submitting.

Additional Requirements

The legal representative must accurately report all assets‚ debts‚ and beneficiary information. Ensure compliance with state-specific guidelines for executors and administrators. Maintain detailed records for verification purposes.

Legal Representative Responsibilities

The legal representative‚ such as an executor or administrator‚ is responsible for filing the estate tax return and ensuring compliance with New Jersey tax laws. They must accurately report the decedent’s assets‚ debts‚ and beneficiaries as of the date of death. The representative is also required to maintain detailed records and provide documentation to support the information reported on the return. Additionally‚ they must handle beneficiary information securely and ensure all tax obligations are met. Failure to comply may result in penalties‚ emphasizing the importance of careful adherence to state guidelines and regulations.

Beneficiary Information

Accurate beneficiary information is crucial for the estate tax return. The legal representative must list all beneficiaries‚ including their names‚ addresses‚ and relationship to the decedent. This ensures proper distribution of assets and adherence to tax obligations. Beneficiaries may be responsible for reporting inherited assets on their personal tax returns; The estate must provide each beneficiary with necessary documentation‚ such as a Schedule K-1‚ detailing their share. This transparency aids in avoiding disputes and ensures compliance with New Jersey tax regulations.

Asset and Debt Reporting

Accurate reporting of the decedent’s assets and debts is essential for the estate tax return. Assets include real estate‚ securities‚ personal property‚ and business interests. Debts‚ such as mortgages or liens‚ must also be detailed. The gross estate value is determined by subtracting debts from total assets. This step ensures the correct calculation of the taxable estate and compliance with New Jersey tax laws. Proper documentation and valuation of these items are critical to avoid errors or disputes during the tax process;

Assistance and Resources

The NJ Division of Taxation offers phone support at 609-292-5033‚ Monday to Friday‚ 8:30 a.m. to 4:30 p.m; Visit their website for forms‚ guidelines‚ and customer support.

Contact Information for the NJ Division of Taxation

The NJ Division of Taxation can be reached at 609-292-5033‚ Monday through Friday‚ 8:30 a.m. to 4:30 p.m. Mailing address: PO Box 249‚ Trenton‚ NJ 08695-0249. Fax submissions to 609-292-5033. Visit nj.gov/taxation for forms‚ guidelines‚ and customer support. Representatives assist with inheritance and estate tax inquiries‚ status checks‚ and form requests. Ensure to keep copies of all submitted documents for records. The Division also provides updated information on tax laws and filing procedures to help executors and beneficiaries comply with state requirements efficiently.

Official Guidelines and Forms

The New Jersey Division of Taxation provides official guidelines and forms for estate tax returns on their website at nj.gov/taxation. Key forms include Form IT-R for inheritance tax‚ Form NJ-1041 for estate tax‚ and Form NJ-1041SB for election information. These forms‚ along with detailed instructions‚ ensure accurate filing and compliance with state tax laws. The website also offers resources for understanding tax calculations‚ exemptions‚ and deadlines. Users can download forms‚ access filing instructions‚ and review updated guidelines to navigate the estate tax process efficiently. These resources are essential for executors and legal representatives to fulfill their obligations accurately.

Customer Support and Inquiries

For assistance with estate tax-related questions‚ contact the New Jersey Division of Taxation’s Inheritance and Estate Tax Service Center at 609-292-5033. Office hours are Monday through Friday‚ 8:30 a.m. to 4:30 p.m.‚ excluding state holidays. You can also fax inquiries to 609-292-5033. Representatives are available to address questions about form submissions‚ return status‚ and tax obligations. Additionally‚ the Division provides resources and guidelines on their website at nj.gov/taxation‚ ensuring access to updated information and support for executors and legal representatives.

Special Cases

Special cases include estates involving non-resident decedents and those filing on a fiscal year basis‚ requiring specific reporting and compliance with New Jersey tax regulations.

Non-Resident Decedents

For non-resident decedents‚ New Jersey estate tax applies only to assets located within the state‚ such as real estate or tangible property. Executors must file Form IT-R to report these assets. The tax is calculated based on the value of New Jersey-based assets‚ following specific state guidelines. Non-resident estates require careful documentation to ensure compliance with local tax laws. Legal representatives should consult official resources to understand filing requirements and deadlines. Proper reporting is essential to avoid penalties and ensure accurate tax assessment for non-resident estates with New Jersey assets.

Estate Tax for Fiscal Year Filers

Estate tax for fiscal year filers requires reporting income received after the decedent’s death. Executors must file Form 1041 (federal) and Form NJ-1041 (state) to report income and deductions. Fiscal year filers must align their reporting with federal tax standards. The estate tax return must be filed within nine months of the decedent’s death‚ with an automatic six-month extension available. Specific forms like Form NJ-1041SB provide election information for fiscal year estates. Legal representatives should ensure accurate reporting to comply with New Jersey tax laws and avoid penalties. Consultation with tax professionals is recommended for complex cases. Proper documentation is essential for timely and accurate filing.

Processing and Refunds

NJ estate tax returns typically take four to 12 weeks to process. Refunds are issued after processing completion‚ with electronic filings generally processed faster than paper submissions.

Processing Time for Returns

The New Jersey Division of Taxation typically processes estate tax returns within four to 12 weeks. Electronic filings are generally processed faster than paper submissions. Ensure all information is accurate to avoid delays. The processing period begins once the completed return and all required documentation are received. Status updates can be checked online or by contacting the Division directly. Delays may occur if additional information is needed. The Division of Taxation prioritizes efficient processing to ensure timely resolution of all returns.

Refund Procedures

If an estate tax return results in an overpayment‚ the New Jersey Division of Taxation will issue a refund. Refunds are processed after the return is approved‚ typically within four weeks of receipt. Ensure all information is accurate to avoid delays. Refunds are issued via check or direct deposit‚ depending on the filing method. Estates must request refunds within the statutory timeframe. If errors are found‚ corrections may delay the refund process. Contact the Division of Taxation for status updates or to resolve issues. Refunds are subject to review and approval by the state tax authority.

Recent Updates and Changes

New Jersey has introduced legislative updates for 2025‚ affecting estate tax filings. Recent Tax Court decisions also impact tax calculations and return submissions‚ ensuring compliance with updated regulations.

2025 Legislative Updates

The 2025 legislative updates bring significant changes to New Jersey estate tax filings. Key modifications include adjustments to tax brackets‚ exemption thresholds‚ and filing deadlines. Executors must now consider these updates when preparing returns. The new laws aim to align state regulations with federal guidelines‚ simplifying compliance for estates. Additionally‚ electronic filing is now mandatory for estates exceeding a certain value. These changes took effect on January 1‚ 2025‚ impacting all returns filed after this date. Legal representatives should consult updated forms and guidelines to ensure adherence to the revised requirements‚ avoiding penalties and ensuring accurate submissions.

Impact of Recent Tax Court Decisions

Recent Tax Court decisions have clarified key aspects of New Jersey estate tax filings‚ particularly regarding asset valuation and taxable gifts. A notable case‚ Rucksapol Jiwungkul‚ as Executor of the Estate of Maurice R. Connolly‚ Jr. v. Director‚ Division of Taxation‚ addressed the interpretation of “date of death” values and their impact on tax liability. These rulings emphasize the importance of accurate reporting and adherence to updated guidelines. Executors and tax practitioners must now consider these judicial interpretations to ensure compliance and avoid disputes. Staying informed about such decisions is crucial for navigating the complexities of estate tax filings effectively.

Filing the New Jersey estate tax return requires careful preparation and adherence to guidelines. Ensure all forms are submitted and payments made by the deadline to avoid penalties and ensure compliance with state laws.

Final Checklist for Filing

- Verify completion of Form NJ-1041 and Form IT-R as required.

- Ensure all signatures are included from the legal representative and preparer.

- Confirm payment of taxes owed or note payment arrangements if filing for an extension.

- Double-check the filing deadline‚ ensuring submission within 9 months of the decedent’s death.

- Include all supporting documents‚ such as asset appraisals and beneficiary information.

- Submit the return to the correct address: PO Box 249‚ Trenton‚ NJ 08695-0249.

- Retain a copy of the return and all supporting documents for records.

Next Steps After Submission

After submitting the estate tax return‚ confirm receipt by contacting the NJ Division of Taxation at 609-292-5033. Allow 4-12 weeks for processing‚ depending on filing method. If issues arise‚ address them promptly to avoid delays. Refunds‚ if applicable‚ will be processed post-verification. Maintain records of submission and payments for future reference. For inquiries‚ utilize the Division’s customer support or visit their website. Ensure all beneficiaries are informed of the return’s status. Keep track of deadlines for any required follow-up actions or additional documentation requests.